Our MissionTo employ science and technology to achieve a superior and sustainable approach to investment management.

About Us

A team that lives its core values every day

Firm Overview

Systematica Investments launched in January 2015 after a decade of experience managing investor capital and a track record dating back to 2004.

Systematica is an innovative technology-driven firm focused on a quantitative and systematic approach to investing. The firm was founded by Leda Braga and has an investment philosophy based upon a disciplined research process, technological innovation and operational excellence. Systematica Investments has a global presence with offices in Jersey, Geneva, London, New York Singapore and Shanghai.

Our Values

Excellence, Innovation, Teamwork, Integrity, Fun

-

Excellence

The pursuit of excellence permeates all of Systematica’s activities. In Leda’s words, “I don’t know if we are the best at what we do, but we certainly work hard every day aiming to be just that.”

The team has amassed an impressive list of industry awards over the years – including over fifteen awards and around forty nominations since 2015. -

Innovation

Technology is making firm in-roads into the world of investment management and Systematica has been at the leading edge of that wave for over a decade now. New, exotic data sources, the ability to trade markets that in the past had been inaccessible, electronic trading… These are all trends that benefit firms with a tradition of innovation.

Systematica profits from years of investment in technology and proprietary trading platforms. We are passionate about devising solutions and technology is the key driver of our constant search for more creative approaches to delivering returns and managing risk. -

Teamwork

One Team, One Dream mentality! Our platform enables us to be agile, flexible and robust and our people are at the heart of this. We are a group of high calibre professionals looking to pursue our Core Mission. Collaborative working environment within and across all functional teams. Rigorous review by peers throughout the research and development cycle.

-

Integrity

Intensely aware that we are responsible for clients’ assets, the Systematica Team lives and breathes integrity. Integrity is natural in an environment which is transparent and fair.

-

Fun

… and we have fun along the way! The Systematica team is characterised by its collective sense of humour. This sense of humour is part of our serious day-to-day work life but also shows in other team activities such as the Systematica band or the sport and fitness initiative across the firm – “Systemaction”.

OUR INVESTMENT PHILOSOPHY Analysis, not emotions! What gets measured gets managed. We aim to be systematic investors and avoid intervening with the algorithms - our interaction with the models is via the research process.

Significant investment in technology – our trading platform is in its third generation. All aspects of the investment process and platform are subject to continuous research and improvement.

Management Team

A vibrant and energetic Management Team typically sitting in open plan offices and working collaboratively with the broader team.

-

Leda Braga

Chief Executive Officer

-

Paul Rouse

Chief Financial Officer

Chief Operating Officer -

Matthias Hagmann

Co-Chief Investment Officer

-

Jean-Pierre Selvatico

Co-Chief Investment Officer

-

Ben Dixon

General Counsel

Chief Compliance Officer -

Ben Maxmin

Head of Sales and Investor Relations

Leda Braga

Chief Executive Officer

Leda acts as CEO of Systematica Investments, an institutional hedge fund manager with approximately $17 billion in assets under management and offices in London, Geneva, Singapore, Shanghai and Jersey. Systematica was formed in January 2015 as a spin-off of BlueCrest Capital, where Leda was President and Head of Systematic Trading for 14 years since 2001. Prior to BlueCrest Leda was part of Cygnifi Derivatives Services (a J.P. Morgan spin-off). At Cygnifi she was a member of the management team and was head of its Valuation Service. Prior to Cygnifi, Leda spent nearly seven years at J.P. Morgan as a Quantitative Analyst in the derivatives research team. Her past experience includes modelling of interest rate exotics, FX/interest rate hybrid instruments and equity derivatives. She holds a PhD in Engineering from Imperial College London, where she worked as a lecturer and led research projects for over three years prior to joining J.P. Morgan. In addition, Leda has served on the advisory board of the pension fund of the CERN in Geneva and on the advisory board of the London School of Economics' Systemic Risk Centre. Leda currently serves on the board of trustees of the SBAI – the Standards Board of Alternative Investments and on the NY Fed’s Investment Advisory Committee on Financial Markets (IACFM).

Paul Rouse

Chief Financial Officer

Chief Operating Officer

Paul joined Systematica on launch in January 2015 as the Chief Financial Officer. He was further appointed as Chief Operating Officer for Systematica in June 2017 becoming responsible for Operations, Risk and the Operating Committee in addition to Human Resources, Fund Accounting, Corporate Accounting, Tax and the Client Service functions. Prior to joining Systematica, Paul served as Head of Product Control at BlueCrest managing teams in London, New York and Singapore. Paul joined BlueCrest in 2006 and for over 8.5 years covered all functional areas within the BlueCrest Product Control function. Previously, Paul was a Product Control manager at Goldman Sachs for 3 years focusing on equity derivatives trading. Paul trained as a Chartered Accountant at Ernst and Young within their Corporate Tax business, qualifying as an ACA in January 2003. He holds a BSc (Hons) in Marine Biology from Newcastle University.

Matthias Hagmann

Co-Chief Investment Officer

Matthias joined Systematica on launch in January 2015 as a Product Manager and was further appointed into the Chief Investment Office in 2019. Prior to joining Systematica, Matthias worked as a Product Manager at BlueCrest. Matthias joined BlueCrest in November 2014 from AHL, Man Investments. Matthias led AHL’s largest research and investment management team, being responsible for all equity strategies (systematic macro (futures), single name equity) trading in the AHL Diversified, Dimension and Evolution programmes. Previous to AHL he was Head of Quantitative Research at Concordia Advisors, a multi-strategy hedge fund being now part of the Mariner Investment Group. Matthias graduated with distinction from the MSc in Econometrics and Mathematical Economics (London School of Economics), and further holds a PhD in Financial Econometrics from the Swiss Finance Institute. His research is published in high-profile academic journals such as Econometrica and the Journal of Econometrics.

Jean-Pierre Selvatico

Co-Chief Investment Officer

Jean-Pierre (JP) joined Systematica in January 2017 as Head of Trading and Counterparty Management and was further appointed into the Chief Investment Office in 2019. JP joined Systematica from Pictet, Geneva, where he was Head of Hedge Funds and a member of Pictet Alternative Advisors’ investment committee. Prior to this, he was a managing director at Barclays Capital, London, in charge of the European interest rate options desk. His previous experience includes Credit Suisse First Boston, London, and 8 years at J.P. Morgan (Paris, Tokyo, London, New York) where he headed the USD interest rate options desk. Jean-Pierre holds Masters degrees from Ecole Polytechnique and Ecole Nationale de la Statistique et de l'Administration Economique (ENSAE), Paris.

Ben Dixon

General Counsel

Chief Compliance Officer

Ben joined Systematica on launch in January 2015 as General Counsel and Chief Compliance Officer. Prior to joining Systematica, Ben worked for BlueCrest for 9 years as Legal Counsel. He joined BlueCrest in 2005 from McDermott, Will & Emery, where he was an Associate Solicitor in the corporate department. He qualified as a solicitor in September 2003 with Allen & Overy in London, where he worked in the corporate and mergers & acquisitions department. Ben graduated from Queens' College, Cambridge University in 2000 and holds MA (Cantab) Law. He undertook his LPC at Nottingham Law School in 2001.

Ben Maxmin

Head of Sales and Investor Relations

Ben leads the global business development and investor relations function for Systematica Investments. Ben rejoined Systematica in 2023 from Intermediate Capital Group (ICG) where he was a Managing Director responsible for distribution across EMEA. He initially joined Systematica in 2015 where he headed up the firm’s UK sales and global consultant relationships until 2021. Prior to Systematica, Ben spent 7 years at J.P. Morgan Asset Management where he held several positions, most latterly in the Global Strategic Relationships group, where he was responsible for distribution to the firm's key wealth accounts. Prior to J.P. Morgan, he worked in HSBC’s Investment Banking Division in FX Sales. Ben is a Chartered Alternative Investment Analyst (CAIA) and holds a BA (Hons) in Management Studies and Spanish from the University of Leeds.

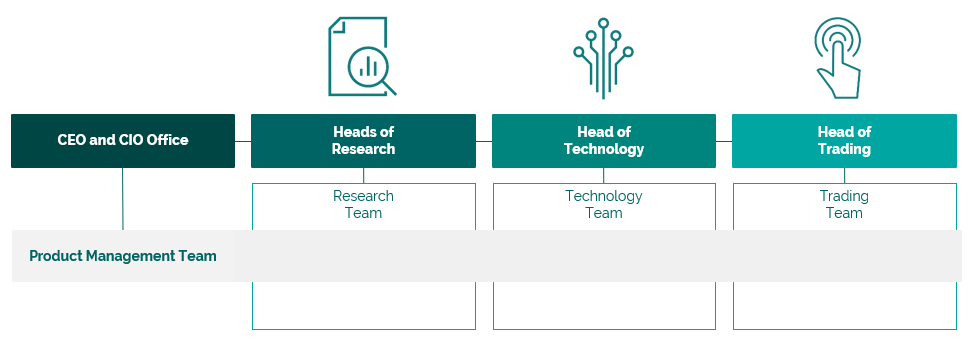

Investment Team

The Investment Team is organised functionally across three lines; Research, Technology and Trading with the Product Management team providing strategic oversight, coordination and development direction.

Any communications contained on this website are issued by: (i) Systematica Investments Limited (“SIL”) acting solely in its capacity as general partner of Systematica Investments LP (“SILP”), (ii) Systematica Investments GP Limited and acting through its Geneva branch (“SIGPL”), (iii) Systematica Investments Singapore Pte. Limited (“SISPL”) and/or (iv) Systematica Investments UK LLP (“SIUK”), (each and together “Systematica Investments”). Systematica Investments shall mean: (i) for all purposes, except for issue into the United States or issue to U.S. persons, issue into Australia or to Australian persons, issue into Singapore or to Singaporean persons, or issue into Switzerland or to Swiss persons, SIUK; (ii) only for the purposes of issue into the United States or issue to U.S. persons, SIL acting solely in its capacity as general partner of SILP; (iii) for the purposes of issue into Australia or to Australian persons or issue into Singapore or to Singaporean persons, SISPL; and (iv) only for the purposes of issue into Switzerland or to Swiss persons, SIGPL acting through its Geneva branch.

SIL is registered with the U.S. Securities and Exchange Commission (the “SEC”) as an investment adviser under the U.S. Investment Advisers Act of 1940, as amended (the “Advisers Act”). SIL is registered with the U.S. Commodity Futures Trading Commission (the “CFTC”) as a commodity trading advisor and a commodity pool operator and is a member of the U.S. National Futures Association (the “NFA”) in such capacities and is approved by the NFA as a swap firm. SIL as general partner of SILP is licensed and regulated by the Jersey Financial Services Commission (the “JFSC”) under the Financial Services (Jersey) Law 1998 (the “FSJL”) to conduct fund services business in and from within Jersey. The JFSC does not take any responsibility for the financial soundness of the Funds (as defined below) or for the correctness of any statements made or expressed herein. The JFSC is protected by the FSJL against liability arising from the discharge of its functions under that law. SIGPL is licensed and regulated by the JFSC under the FSJL to conduct fund services business in and from within Jersey and is registered with the CFTC as a commodity trading advisor, is a member of the NFA in such capacity and is approved by the NFA as a swap firm, and its Geneva branch is authorised by the Swiss Financial Market Supervisory Authority FINMA (“FINMA”) as a branch of a Manager of Collective Assets. SIUK is authorised and regulated by the Financial Conduct Authority of the United Kingdom (the “FCA”) and is registered with the CFTC as a commodity trading advisor, is a member of the NFA in such capacity and is approved by the NFA as a swap firm. SISPL is exempt from the requirement to hold an Australian financial services licence in respect of the financial services it provides to “wholesale investors” in Australia (as that term is defined in the Corporations Act 2001 (Cth)), is regulated by the Monetary Authority of Singapore (the “MAS”) under the laws of Singapore, which differ from Australian laws, and is registered with the CFTC as a commodity trading advisor, is a member of the NFA in such capacity and is approved by the NFA as a swap firm. Each of SIUK, SISPL and SIGPL is registered with the SEC as an investment adviser under the Advisers Act. Such registrations, memberships, approvals, authorizations and licenses do not imply that any of the SEC, the CFTC, the NFA, the JFSC, FINMA, the FCA or the MAS have approved any applicable Systematica Investments entity’s qualifications to provide the advisory services set forth in this document.

For the purposes of this disclaimer the “funds” referred to will include each of the funds described herein as well as any other funds, sub-funds, managed accounts, special purpose vehicles or investment vehicles in respect of which SIL has been appointed to act as or shall be appointed to act as, investment manager (each, a “Fund” and together, the “Funds”).

In respect of any content on this website operated by SIUK, the following applies. The contents of this website may only be accessed by persons that are resident, domiciled or with a registered office in the United Kingdom who (a) fall within the definition of “professional clients” as defined in the FCA’s Handbook of Rules and Guidance (the “FCA Handbook”); and (b) are persons who may lawfully receive access to such information under the Financial Services and Markets Act 2000 (Promotion of Collective Investment Schemes) (Exemptions) Order 2001 (the “PCISE Order”) and/or Chapter 4.12B of the FCA Handbook’s Conduct of Business Sourcebook (the persons described in (a) and (b) above together, the “Relevant Persons”). Access by persons who are not Relevant Persons is strictly unauthorised.

In respect of content on this website operated by Systematica Investments (excluding SIUK), the following applies. The contents of this website may only be accessed by persons that are resident, domiciled or with a registered office in the United Kingdom who (a) fall within the definition of “professional investors” as defined in the Alternative Investment Fund Managers Regulation (SI 2013/1773) (as amended); and (b) are persons who may lawfully access such information under the Financial Services and Markets Act 2000 (Financial Promotion) Order 2001 (the “FPO”) including by virtue of being investment professionals within the meaning of Article 19(5) of the FPO (the persons described in (a) and (b) above together, the “Permitted Persons”). Access by persons who are not Permitted Persons is strictly unauthorised.

Where communications contained on this website are issued by SIL, the following applies. Communications contained on this website have been prepared in accordance with the requirements of the FSJL and any other legislation, regulations and orders which may be applicable from time to time, together with the requirements of any relevant codes of practice and guidance issued by the JFSC from time to time (the “JFSC Regulatory Requirements”). The information contained in such communications is directed by SIL exclusively at persons who are professional clients or eligible counterparties for the purposes of the JFSC Regulatory Requirements, or, if to U.S. persons (as defined under Regulation S promulgated under the U.S. Securities Act of 1933, as amended (the “Securities Act”)), to U.S. persons who are both accredited investors (as defined under Regulation D promulgated under the Securities Act) and qualified purchasers (as defined in the U.S. Investment Company Act of 1940, as amended (the “Investment Company Act”)).

Where communications contained on this website are issued by SISPL, such communications have been prepared without taking into account the objectives, financial situation or needs of Australian persons who receive such communications. Before making an investment decision, Australian persons who receive such communications should consider the relevant offering document, if applicable, and assess whether the product is appropriate given your objectives, financial situation or needs. Communications contained on this website are only to be made available to “wholesale investors” under the Corporations Act 2001 (Cth).

The interests in the Funds have not been filed with or approved or disapproved by any regulatory authority of the United States or any state thereof, nor has any such regulatory authority passed upon or endorsed the merits of an offering of a Fund or the accuracy or adequacy of communications contained on this website. Any representation to the contrary is unlawful.

PURSUANT TO AN EXEMPTION FROM THE COMMODITY FUTURES TRADING COMMISSION IN CONNECTION WITH ACCOUNTS OF QUALIFIED ELIGIBLE PERSONS, THIS BROCHURE OR ACCOUNT DOCUMENT IS NOT REQUIRED TO BE, AND HAS NOT BEEN, FILED WITH THE COMMODITY FUTURES TRADING COMMISSION. THE COMMODITY FUTURES TRADING COMMISSION DOES NOT PASS UPON THE MERITS OF PARTICIPATING IN A TRADING PROGRAM OR UPON THE ADEQUACY OR ACCURACY OF THE COMMODITY TRADING ADVISOR DISCLOSURE. CONSEQUENTLY, THE COMMODITY FUTURES TRADING COMMISSION HAS NOT REVIEWED OR APPROVED THIS TRADING PROGRAM OR THIS BROCHURE OR ACCOUNT DOCUMENT.

The distribution of information or documents contained in communications on this website may be further restricted by law. No action has been or will be taken by SIL or any Fund to permit the possession or distribution of the information or documents contained in communications on this website in any jurisdiction (other than as expressly stated by Systematica Investments) where action for that purpose may be required. Accordingly, documents and information contained in communications on this website may not be distributed, or forwarded to recipients, in any jurisdiction except under circumstances that will result in compliance with any applicable laws and regulations. It is the responsibility of the recipient of information or documents contained in communications on this website (or its agent or adviser, as the case may be) to ensure that any individuals (whether employed by them or otherwise) who receive the information herein do so in accordance with applicable law and regulation. Persons to whom documents and information contained in communications on this website are communicated should inform themselves about and observe any such restrictions.

Recipients of any communications contained on this website should note that electronic communication, whether by email, website, SWIFT or otherwise, is an unsafe method of communication. Emails and SWIFT messages may be lost, delivered to the wrong address, intercepted or affected by delays, interference by third parties or viruses and their confidentiality, security and integrity cannot be guaranteed. None of the Funds or Systematica Investments bear any liability or responsibility therefor.

Distribution and Selling Restrictions: The distribution of documents and information contained in communications on this website and the offering or purchase of interests in the Funds may be restricted in certain jurisdictions. No persons receiving a copy of documents or information contained in communications on this website in any such jurisdiction may treat such information or documents as constituting marketing or an invitation to them to subscribe for interests in the Funds. Accordingly, documents and information contained in communications on this website do not constitute marketing, an offer or solicitation by anyone in any jurisdiction in which such marketing, offer or solicitation is not lawful or in which the person marketing or making such offer or solicitation is not qualified to do so or to anyone to whom it is unlawful to market or make such offer or solicitation. It is the responsibility of any persons in possession of documents or information contained in communications on this website, including individuals who may be employed by or a consultant to the recipient, to inform themselves of, and to observe, all applicable laws and regulations of any relevant jurisdiction. If any recipient, including individuals, is or becomes aware that the receipt of documents or information contained in communications on this website by them contravenes any law or regulation, they must destroy it or return it to Systematica Investments immediately. Prospective applicants for interests in the Funds should inform themselves as to the legal requirements of so applying and any applicable exchange control regulations and taxes in the countries of their respective citizenship, residence or domicile.

Information for investors in the European Economic Area (the “EEA”) and the United Kingdom (“UK”): Investors that are resident, domiciled or with a registered office in any Member State of the EEA or the UK should note that access to this website is restricted to “professional investors” within the meaning of Directive 2011/61/EU (as amended and as implemented into local law or regulations in each EEA Member State, and in respect of the UK, as it forms part of UK law by virtue of the European Union (Withdrawal) Act 2018 (as amended), “AIFMD”). Access by persons that are not “professional investors” within the meaning of AIFMD is strictly unauthorised.

Information for investors in Switzerland: Any distribution or offer of interests in the Funds in Switzerland is exclusively made to, and directed at, qualified investors (“Qualified Investors”), as defined in the Swiss Collective Investment Schemes Act of 23 June 2006, as amended, and its implementing ordinance. Accordingly, the Funds have not been and will not be registered with FINMA for distribution to non-qualified investors. Any Funds which are Delaware limited partnerships are not distributed in Switzerland and are not available for subscription by investors in Switzerland. If a Swiss representative has been appointed in respect of a Fund, offering materials relating to interests in that Fund may be obtained by Qualified Investors in Switzerland from the Swiss representative and/or authorised distributors. Swiss representative (where appointed): Mont-Fort Funds AG, 63 Chemin Plan-Pra, 1936 Verbier, Switzerland. Swiss paying agent (where appointed): Helvetische Bank AG, Seefeldstrasse 215, CH-8008 Zurich, Switzerland. In respect of the distribution of interests in the Funds in and from Switzerland, the place of performance and jurisdiction is the registered office of the Swiss representative. Systematica Investments GP Limited, Geneva Branch is affiliated with the Swiss Arbitration Centre (formerly known as the Swiss Chambers’ Arbitration Institution) for the provision of ombudsman services under the Swiss Federal Act on Financial Services.

Information for investors in Australia: To the extent that communications contained on this website are issued by SISPL, such communications has been prepared without taking into account the objectives, financial situation or needs of Australian persons who receive such communications. Before making an investment decision, Australian persons who receive such communications should consider the offering document, if applicable, and assess whether the product is appropriate given your objectives, financial situation or needs. Communications contained on this website are only to be made available to ‘wholesale investors’ under the Corporations Act 2001 (Cth).

Information for investors in Singapore: The Funds are not authorised or recognised by the MAS and interests in any Funds are not allowed to be offered to the retail public. Communications contained on this website and any other communication or material in connection with the offer, sale, invitation for subscription or purchase of interests in any Fund may not be circulated or distributed, nor may interests in any Fund be offered, sold or be made the subject of an invitation for subscription or purchase, whether directly or indirectly, to the public or any member of the public in Singapore other than a person who is an accredited investor or an institutional investor (each as defined under the Securities and Futures Act (Chapter 289) of Singapore) (“SFA”) or unless otherwise permitted under any applicable exemption. Communications contained on this website and any other communications or material in connection with the offer or sale, or invitation for subscription or purchase, of interests may not be circulated or distributed, nor may interests be offered or sold, or be made the subject of an invitation for subscription or purchase, whether directly or indirectly, to persons in Singapore other than in accordance with the conditions set out in the applicable provisions of the SFA. Communications contained on this website and any other communication or material issued in connection with the offer or sale is not a prospectus as defined in the SFA and has not been registered as a prospectus with the MAS. Accordingly, statutory liability under the SFA in relation to the content of prospectuses would not apply. Each prospective investor should consider carefully whether the investment is suitable for him.

SIL, as general partner of SILP (SIL together with SILP and each of their subsidiaries and affiliates, the “Systematica Group”), was appointed as investment manager of the Funds on or after 1 January 2015 following the “spin-out” of the Systematica Group. Any Fund performance information in communications contained on this website relating to dates prior to 1 January 2015 illustrates the performance of the Funds whilst the predecessors of the Systematica Group were appointed as investment manager to the Funds. There is no guarantee that past performance of the Funds will be replicated under the management of the Systematica Group.

Communications contained on this website are not intended to constitute, and should not be construed as, investment advice, investment recommendations or investment research. Current and prospective investors acknowledge that no member of the Systematica Group has conducted or will conduct the activity of reception and transmission of orders in relation to the interests of the Funds, whether for the Funds, investors or otherwise. Potential investors in the Funds should seek their own independent financial, tax, legal and other advice. Communications contained on this website have been made available to you for informational purposes only and may not be relied upon by you in evaluating the merits of investing in any securities or interests referred to herein or for any other purpose. Communications contained on this website are not intended as and are not to be taken as an offer or solicitation with respect to the purchase or sale of any security or interest, nor does it constitute an offer or solicitation in any jurisdiction, including those in which such an offer or solicitation is not authorised or to any person to whom it is unlawful to make such a solicitation or offer. Before making any investment decision you should obtain independent legal, tax, accounting or other professional advice, as appropriate, none of which is offered to you by the members of the Systematica Group or any of their affiliates. None of the members of the Systematica Group or any of their affiliates accepts any duty of care to you in relation to any investment in the Funds.

The terms of investment in any of the Funds described herein or any other Fund are solely as set out in the relevant Fund’s prospectus or private placement memorandum (including any supplements thereto), as the case may be, application forms and/or memorandum and articles of association or limited partnership agreement or instrument of incorporation, as the case may be (collectively, the “Fund Documents”). Before acquiring an interest in any Fund, each prospective investor is required to confirm that it has carefully reviewed the various risks of an investment in the Fund, as set out in the Fund Documents, and is required to acknowledge and agree to the existence of any actual and potential conflicts of interests described in the Fund Documents and waive, to the fullest extent permitted by any applicable law, any claim with respect to the existence of any such conflicts.

Communications contained on this website may contain simulated performance results achieved by means of the retroactive application of Systematica Investments’ investment methodology, or the real-time application of a hypothetical capital allocation to such strategy. Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any particular trading program will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

Although the information in communications contained on this website is believed to be materially correct as at the date of issue, no representation or warranty is given as to the accuracy of any of the information provided. Furthermore, no representation or warranty is given in respect of the correctness of the information contained herein as at any future date. Certain information included in communications contained on this website is based on information obtained from third-party sources considered to be reliable. Any projections or analysis provided to assist the recipient of communications contained on this website in evaluating the matters described therein may be based on subjective assessments and assumptions and may use one among many alternative methodologies that produce different results. Accordingly, any projections or analysis should not be viewed as factual and should not be relied upon as an accurate prediction of future results. Furthermore, to the extent permitted by law, SIL, SILP, SIUK, SISPL, SIGPL, the Funds, and their branches, affiliates, agents, service providers and professional advisers assume no liability or responsibility and owe no duty of care for any consequences of any person acting or refraining to act in reliance on the information contained in communications on this website or for any decision based on it.

PAST, PROJECTED AND/OR SIMULATED PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. Past, projected and/or simulated performance may not be a reliable guide to future performance. The actual performance realised by any given investor will depend on numerous factors and circumstances. Communications contained on this website may include returns for various indices. These indices are not intended to be direct benchmarks for a particular Fund, nor are they intended to be indicative of the type of assets in which a particular Fund may invest. The assets invested in by any of the Funds will likely be materially different from the assets underlying these indices, and will likely have a significantly different risk profile. The target returns, volatility and Sharpe ratio figures quoted are targets only and are based over the long term on the performance projections of the investment strategy and market interest rates at time of modelling and therefore may change.

Interests in the Funds and other investments and investment services to which communications contained on this website relate are only available to the persons referred to in the relevant paragraphs above, and other persons should not act on the information contained therein.

Any decision to purchase securities or interests with respect to any of the Funds described herein must be based solely upon the information contained in the Fund Documents, which must be received and reviewed prior to any investment decision. Any person subscribing for an investment must be able to bear the risks involved (including the risk of a total loss of capital) and must meet the suitability requirements relating to such investments. Some or all alternative investment programmes may not be suitable for certain investors.

Among the risks we wish to call to the particular attention of current and prospective investors are the following: (1) each Fund’s investment programme is speculative in nature and entails substantial risks; (2) the investments of each Fund may be subject to sudden and large falls in price or value and there could be a large loss upon realisation of a holder’s investment, which could equal the total amount invested; (3) as there is no recognised market for many of the investments of the Funds, it may be difficult or impossible for a Fund to obtain complete and/or reliable information about the value of such investments or the extent of the risks to which such investments are exposed; (4) the use of a single adviser group could mean a lack of diversification and, consequently, higher risk, and may depend upon the services of key personnel, and if certain or all of them become unavailable, the Funds may prematurely terminate; (5) an investment in a Fund is illiquid and there is no secondary market for the sale of interests in a Fund and none is expected to develop; (6) there are restrictions on transferring interests in a Fund; (7) SIL and its affiliates may receive performance-based compensation, which may result in riskier investments, and the Funds’ fees may offset trading profits; (8) the Funds are subject to certain conflicts of interest; (9) certain securities and instruments in which the Funds may invest can be highly volatile; (10) the Funds may be leveraged; (11) a substantial portion of the trades executed for the Funds take place on non-U.S. exchanges; (12) changes in rates of exchange may also have an adverse effect on the value, price or income of the investments of each Fund; and (13) the Funds are not mutual funds pursuant to, and are therefore not subject to, regulation under the Investment Company Act.

As announced in June 2022, the investment management business of First Quadrant, LLC (“First Quadrant”) was acquired by SIL acting solely in its capacity as general partner of SILP, with certain clients of First Quadrant transferring to SIL before the end of 2022. The information contained in documents and information contained in communications on this website may relate to, or contain, information in respect of, First Quadrant and its management of the assets of certain accounts and investment strategies referred to herein. This information may be subject to updating, completion and amendment. Any performance data and other information in communications contained on this website illustrates the performance of the relevant accounts and strategies (as applicable), and/or provides information in relation to them, in respect of the period during which First Quadrant was appointed as investment manager. The members of the Systematica Group take no responsibility for any such data or information which has not been checked or verified independently by any of the members of the Systematica Group. There is no guarantee that past performance of the relevant accounts and strategies (to the extent managed by First Quadrant) will be replicated under the management of the Systematica Group.

Any communications contained on this website are issued by: (i) Systematica Investments Limited (“SIL”) acting solely in its capacity as general partner of Systematica Investments LP (“SILP”), (ii) Systematica Investments GP Limited and acting through its Geneva branch (“SIGPL”), (iii) Systematica Investments Singapore Pte. Limited (“SISPL”) and/or (iv) Systematica Investments UK LLP (“SIUK”), (each and together “Systematica Investments”). Systematica Investments shall mean: (i) for all purposes, except for issue into the United States or issue to U.S. persons, issue into Australia or to Australian persons, issue into Singapore or to Singaporean persons, or issue into Switzerland or to Swiss persons, SIUK; (ii) only for the purposes of issue into the United States or issue to U.S. persons, SIL acting solely in its capacity as general partner of SILP; (iii) for the purposes of issue into Australia or to Australian persons or issue into Singapore or to Singaporean persons, SISPL; and (iv) only for the purposes of issue into Switzerland or to Swiss persons, SIGPL acting through its Geneva branch.

SIL is registered with the U.S. Securities and Exchange Commission (the “SEC”) as an investment adviser under the U.S. Investment Advisers Act of 1940, as amended (the “Advisers Act”). SIL is registered with the U.S. Commodity Futures Trading Commission (the “CFTC”) as a commodity trading advisor and a commodity pool operator and is a member of the U.S. National Futures Association (the “NFA”) in such capacities and is approved by the NFA as a swap firm. SIL as general partner of SILP is licensed and regulated by the Jersey Financial Services Commission (the “JFSC”) under the Financial Services (Jersey) Law 1998 (the “FSJL”) to conduct fund services business in and from within Jersey. The JFSC does not take any responsibility for the financial soundness of the Funds (as defined below) or for the correctness of any statements made or expressed herein. The JFSC is protected by the FSJL against liability arising from the discharge of its functions under that law. SIGPL is licensed and regulated by the JFSC under the FSJL to conduct fund services business in and from within Jersey and is registered with the CFTC as a commodity trading advisor, is a member of the NFA in such capacity and is approved by the NFA as a swap firm, and its Geneva branch is authorised by the Swiss Financial Market Supervisory Authority FINMA (“FINMA”) as a branch of a Manager of Collective Assets. SIUK is authorised and regulated by the Financial Conduct Authority of the United Kingdom (the “FCA”) and is registered with the CFTC as a commodity trading advisor, is a member of the NFA in such capacity and is approved by the NFA as a swap firm. SISPL is exempt from the requirement to hold an Australian financial services licence in respect of the financial services it provides to “wholesale investors” in Australia (as that term is defined in the Corporations Act 2001 (Cth)), is regulated by the Monetary Authority of Singapore (the “MAS”) under the laws of Singapore, which differ from Australian laws, and is registered with the CFTC as a commodity trading advisor, is a member of the NFA in such capacity and is approved by the NFA as a swap firm. Each of SIUK, SISPL and SIGPL is registered with the SEC as an investment adviser under the Advisers Act. Such registrations, memberships, approvals, authorizations and licenses do not imply that any of the SEC, the CFTC, the NFA, the JFSC, FINMA, the FCA or the MAS have approved any applicable Systematica Investments entity’s qualifications to provide the advisory services set forth in this document.

For the purposes of this disclaimer the “funds” referred to will include each of the funds described herein as well as any other funds, sub-funds, managed accounts, special purpose vehicles or investment vehicles in respect of which SIL has been appointed to act as or shall be appointed to act as, investment manager (each, a “Fund” and together, the “Funds”).

In respect of any content on this website operated by SIUK, the following applies. The contents of this website may only be accessed by persons that are resident, domiciled or with a registered office in the United Kingdom who (a) fall within the definition of “professional clients” as defined in the FCA’s Handbook of Rules and Guidance (the “FCA Handbook”); and (b) are persons who may lawfully receive access to such information under the Financial Services and Markets Act 2000 (Promotion of Collective Investment Schemes) (Exemptions) Order 2001 (the “PCISE Order”) and/or Chapter 4.12B of the FCA Handbook’s Conduct of Business Sourcebook (the persons described in (a) and (b) above together, the “Relevant Persons”). Access by persons who are not Relevant Persons is strictly unauthorised.

In respect of content on this website operated by Systematica Investments (excluding SIUK), the following applies. The contents of this website may only be accessed by persons that are resident, domiciled or with a registered office in the United Kingdom who (a) fall within the definition of “professional investors” as defined in the Alternative Investment Fund Managers Regulation (SI 2013/1773) (as amended); and (b) are persons who may lawfully access such information under the Financial Services and Markets Act 2000 (Financial Promotion) Order 2001 (the “FPO”) including by virtue of being investment professionals within the meaning of Article 19(5) of the FPO (the persons described in (a) and (b) above together, the “Permitted Persons”). Access by persons who are not Permitted Persons is strictly unauthorised.

Where communications contained on this website are issued by SIL, the following applies. Communications contained on this website have been prepared in accordance with the requirements of the FSJL and any other legislation, regulations and orders which may be applicable from time to time, together with the requirements of any relevant codes of practice and guidance issued by the JFSC from time to time (the “JFSC Regulatory Requirements”). The information contained in such communications is directed by SIL exclusively at persons who are professional clients or eligible counterparties for the purposes of the JFSC Regulatory Requirements, or, if to U.S. persons (as defined under Regulation S promulgated under the U.S. Securities Act of 1933, as amended (the “Securities Act”)), to U.S. persons who are both accredited investors (as defined under Regulation D promulgated under the Securities Act) and qualified purchasers (as defined in the U.S. Investment Company Act of 1940, as amended (the “Investment Company Act”)).

Where communications contained on this website are issued by SISPL, such communications have been prepared without taking into account the objectives, financial situation or needs of Australian persons who receive such communications. Before making an investment decision, Australian persons who receive such communications should consider the relevant offering document, if applicable, and assess whether the product is appropriate given your objectives, financial situation or needs. Communications contained on this website are only to be made available to “wholesale investors” under the Corporations Act 2001 (Cth).

The interests in the Funds have not been filed with or approved or disapproved by any regulatory authority of the United States or any state thereof, nor has any such regulatory authority passed upon or endorsed the merits of an offering of a Fund or the accuracy or adequacy of communications contained on this website. Any representation to the contrary is unlawful.

PURSUANT TO AN EXEMPTION FROM THE COMMODITY FUTURES TRADING COMMISSION IN CONNECTION WITH ACCOUNTS OF QUALIFIED ELIGIBLE PERSONS, THIS BROCHURE OR ACCOUNT DOCUMENT IS NOT REQUIRED TO BE, AND HAS NOT BEEN, FILED WITH THE COMMODITY FUTURES TRADING COMMISSION. THE COMMODITY FUTURES TRADING COMMISSION DOES NOT PASS UPON THE MERITS OF PARTICIPATING IN A TRADING PROGRAM OR UPON THE ADEQUACY OR ACCURACY OF THE COMMODITY TRADING ADVISOR DISCLOSURE. CONSEQUENTLY, THE COMMODITY FUTURES TRADING COMMISSION HAS NOT REVIEWED OR APPROVED THIS TRADING PROGRAM OR THIS BROCHURE OR ACCOUNT DOCUMENT.

The distribution of information or documents contained in communications on this website may be further restricted by law. No action has been or will be taken by SIL or any Fund to permit the possession or distribution of the information or documents contained in communications on this website in any jurisdiction (other than as expressly stated by Systematica Investments) where action for that purpose may be required. Accordingly, documents and information contained in communications on this website may not be distributed, or forwarded to recipients, in any jurisdiction except under circumstances that will result in compliance with any applicable laws and regulations. It is the responsibility of the recipient of information or documents contained in communications on this website (or its agent or adviser, as the case may be) to ensure that any individuals (whether employed by them or otherwise) who receive the information herein do so in accordance with applicable law and regulation. Persons to whom documents and information contained in communications on this website are communicated should inform themselves about and observe any such restrictions.

Recipients of any communications contained on this website should note that electronic communication, whether by email, website, SWIFT or otherwise, is an unsafe method of communication. Emails and SWIFT messages may be lost, delivered to the wrong address, intercepted or affected by delays, interference by third parties or viruses and their confidentiality, security and integrity cannot be guaranteed. None of the Funds or Systematica Investments bear any liability or responsibility therefor.

Distribution and Selling Restrictions: The distribution of documents and information contained in communications on this website and the offering or purchase of interests in the Funds may be restricted in certain jurisdictions. No persons receiving a copy of documents or information contained in communications on this website in any such jurisdiction may treat such information or documents as constituting marketing or an invitation to them to subscribe for interests in the Funds. Accordingly, documents and information contained in communications on this website do not constitute marketing, an offer or solicitation by anyone in any jurisdiction in which such marketing, offer or solicitation is not lawful or in which the person marketing or making such offer or solicitation is not qualified to do so or to anyone to whom it is unlawful to market or make such offer or solicitation. It is the responsibility of any persons in possession of documents or information contained in communications on this website, including individuals who may be employed by or a consultant to the recipient, to inform themselves of, and to observe, all applicable laws and regulations of any relevant jurisdiction. If any recipient, including individuals, is or becomes aware that the receipt of documents or information contained in communications on this website by them contravenes any law or regulation, they must destroy it or return it to Systematica Investments immediately. Prospective applicants for interests in the Funds should inform themselves as to the legal requirements of so applying and any applicable exchange control regulations and taxes in the countries of their respective citizenship, residence or domicile.

Information for investors in the European Economic Area (the “EEA”) and the United Kingdom (“UK”): Investors that are resident, domiciled or with a registered office in any Member State of the EEA or the UK should note that access to this website is restricted to “professional investors” within the meaning of Directive 2011/61/EU (as amended and as implemented into local law or regulations in each EEA Member State, and in respect of the UK, as it forms part of UK law by virtue of the European Union (Withdrawal) Act 2018 (as amended), “AIFMD”). Access by persons that are not “professional investors” within the meaning of AIFMD is strictly unauthorised.

Information for investors in Switzerland: Any distribution or offer of interests in the Funds in Switzerland is exclusively made to, and directed at, qualified investors (“Qualified Investors”), as defined in the Swiss Collective Investment Schemes Act of 23 June 2006, as amended, and its implementing ordinance. Accordingly, the Funds have not been and will not be registered with FINMA for distribution to non-qualified investors. Any Funds which are Delaware limited partnerships are not distributed in Switzerland and are not available for subscription by investors in Switzerland. If a Swiss representative has been appointed in respect of a Fund, offering materials relating to interests in that Fund may be obtained by Qualified Investors in Switzerland from the Swiss representative and/or authorised distributors. Swiss representative (where appointed): Mont-Fort Funds AG, 63 Chemin Plan-Pra, 1936 Verbier, Switzerland. Swiss paying agent (where appointed): Helvetische Bank AG, Seefeldstrasse 215, CH-8008 Zurich, Switzerland. In respect of the distribution of interests in the Funds in and from Switzerland, the place of performance and jurisdiction is the registered office of the Swiss representative. Systematica Investments GP Limited, Geneva Branch is affiliated with the Swiss Arbitration Centre (formerly known as the Swiss Chambers’ Arbitration Institution) for the provision of ombudsman services under the Swiss Federal Act on Financial Services.

Information for investors in Australia: To the extent that communications contained on this website are issued by SISPL, such communications has been prepared without taking into account the objectives, financial situation or needs of Australian persons who receive such communications. Before making an investment decision, Australian persons who receive such communications should consider the offering document, if applicable, and assess whether the product is appropriate given your objectives, financial situation or needs. Communications contained on this website are only to be made available to ‘wholesale investors’ under the Corporations Act 2001 (Cth).

Information for investors in Singapore: The Funds are not authorised or recognised by the MAS and interests in any Funds are not allowed to be offered to the retail public. Communications contained on this website and any other communication or material in connection with the offer, sale, invitation for subscription or purchase of interests in any Fund may not be circulated or distributed, nor may interests in any Fund be offered, sold or be made the subject of an invitation for subscription or purchase, whether directly or indirectly, to the public or any member of the public in Singapore other than a person who is an accredited investor or an institutional investor (each as defined under the Securities and Futures Act (Chapter 289) of Singapore) (“SFA”) or unless otherwise permitted under any applicable exemption. Communications contained on this website and any other communications or material in connection with the offer or sale, or invitation for subscription or purchase, of interests may not be circulated or distributed, nor may interests be offered or sold, or be made the subject of an invitation for subscription or purchase, whether directly or indirectly, to persons in Singapore other than in accordance with the conditions set out in the applicable provisions of the SFA. Communications contained on this website and any other communication or material issued in connection with the offer or sale is not a prospectus as defined in the SFA and has not been registered as a prospectus with the MAS. Accordingly, statutory liability under the SFA in relation to the content of prospectuses would not apply. Each prospective investor should consider carefully whether the investment is suitable for him.

SIL, as general partner of SILP (SIL together with SILP and each of their subsidiaries and affiliates, the “Systematica Group”), was appointed as investment manager of the Funds on or after 1 January 2015 following the “spin-out” of the Systematica Group. Any Fund performance information in communications contained on this website relating to dates prior to 1 January 2015 illustrates the performance of the Funds whilst the predecessors of the Systematica Group were appointed as investment manager to the Funds. There is no guarantee that past performance of the Funds will be replicated under the management of the Systematica Group.

Communications contained on this website are not intended to constitute, and should not be construed as, investment advice, investment recommendations or investment research. Current and prospective investors acknowledge that no member of the Systematica Group has conducted or will conduct the activity of reception and transmission of orders in relation to the interests of the Funds, whether for the Funds, investors or otherwise. Potential investors in the Funds should seek their own independent financial, tax, legal and other advice. Communications contained on this website have been made available to you for informational purposes only and may not be relied upon by you in evaluating the merits of investing in any securities or interests referred to herein or for any other purpose. Communications contained on this website are not intended as and are not to be taken as an offer or solicitation with respect to the purchase or sale of any security or interest, nor does it constitute an offer or solicitation in any jurisdiction, including those in which such an offer or solicitation is not authorised or to any person to whom it is unlawful to make such a solicitation or offer. Before making any investment decision you should obtain independent legal, tax, accounting or other professional advice, as appropriate, none of which is offered to you by the members of the Systematica Group or any of their affiliates. None of the members of the Systematica Group or any of their affiliates accepts any duty of care to you in relation to any investment in the Funds.

The terms of investment in any of the Funds described herein or any other Fund are solely as set out in the relevant Fund’s prospectus or private placement memorandum (including any supplements thereto), as the case may be, application forms and/or memorandum and articles of association or limited partnership agreement or instrument of incorporation, as the case may be (collectively, the “Fund Documents”). Before acquiring an interest in any Fund, each prospective investor is required to confirm that it has carefully reviewed the various risks of an investment in the Fund, as set out in the Fund Documents, and is required to acknowledge and agree to the existence of any actual and potential conflicts of interests described in the Fund Documents and waive, to the fullest extent permitted by any applicable law, any claim with respect to the existence of any such conflicts.

Communications contained on this website may contain simulated performance results achieved by means of the retroactive application of Systematica Investments’ investment methodology, or the real-time application of a hypothetical capital allocation to such strategy. Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any particular trading program will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

Although the information in communications contained on this website is believed to be materially correct as at the date of issue, no representation or warranty is given as to the accuracy of any of the information provided. Furthermore, no representation or warranty is given in respect of the correctness of the information contained herein as at any future date. Certain information included in communications contained on this website is based on information obtained from third-party sources considered to be reliable. Any projections or analysis provided to assist the recipient of communications contained on this website in evaluating the matters described therein may be based on subjective assessments and assumptions and may use one among many alternative methodologies that produce different results. Accordingly, any projections or analysis should not be viewed as factual and should not be relied upon as an accurate prediction of future results. Furthermore, to the extent permitted by law, SIL, SILP, SIUK, SISPL, SIGPL, the Funds, and their branches, affiliates, agents, service providers and professional advisers assume no liability or responsibility and owe no duty of care for any consequences of any person acting or refraining to act in reliance on the information contained in communications on this website or for any decision based on it.

PAST, PROJECTED AND/OR SIMULATED PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. Past, projected and/or simulated performance may not be a reliable guide to future performance. The actual performance realised by any given investor will depend on numerous factors and circumstances. Communications contained on this website may include returns for various indices. These indices are not intended to be direct benchmarks for a particular Fund, nor are they intended to be indicative of the type of assets in which a particular Fund may invest. The assets invested in by any of the Funds will likely be materially different from the assets underlying these indices, and will likely have a significantly different risk profile. The target returns, volatility and Sharpe ratio figures quoted are targets only and are based over the long term on the performance projections of the investment strategy and market interest rates at time of modelling and therefore may change.

Interests in the Funds and other investments and investment services to which communications contained on this website relate are only available to the persons referred to in the relevant paragraphs above, and other persons should not act on the information contained therein.

Any decision to purchase securities or interests with respect to any of the Funds described herein must be based solely upon the information contained in the Fund Documents, which must be received and reviewed prior to any investment decision. Any person subscribing for an investment must be able to bear the risks involved (including the risk of a total loss of capital) and must meet the suitability requirements relating to such investments. Some or all alternative investment programmes may not be suitable for certain investors.

Among the risks we wish to call to the particular attention of current and prospective investors are the following: (1) each Fund’s investment programme is speculative in nature and entails substantial risks; (2) the investments of each Fund may be subject to sudden and large falls in price or value and there could be a large loss upon realisation of a holder’s investment, which could equal the total amount invested; (3) as there is no recognised market for many of the investments of the Funds, it may be difficult or impossible for a Fund to obtain complete and/or reliable information about the value of such investments or the extent of the risks to which such investments are exposed; (4) the use of a single adviser group could mean a lack of diversification and, consequently, higher risk, and may depend upon the services of key personnel, and if certain or all of them become unavailable, the Funds may prematurely terminate; (5) an investment in a Fund is illiquid and there is no secondary market for the sale of interests in a Fund and none is expected to develop; (6) there are restrictions on transferring interests in a Fund; (7) SIL and its affiliates may receive performance-based compensation, which may result in riskier investments, and the Funds’ fees may offset trading profits; (8) the Funds are subject to certain conflicts of interest; (9) certain securities and instruments in which the Funds may invest can be highly volatile; (10) the Funds may be leveraged; (11) a substantial portion of the trades executed for the Funds take place on non-U.S. exchanges; (12) changes in rates of exchange may also have an adverse effect on the value, price or income of the investments of each Fund; and (13) the Funds are not mutual funds pursuant to, and are therefore not subject to, regulation under the Investment Company Act.

As announced in June 2022, the investment management business of First Quadrant, LLC (“First Quadrant”) was acquired by SIL acting solely in its capacity as general partner of SILP, with certain clients of First Quadrant transferring to SIL before the end of 2022. The information contained in documents and information contained in communications on this website may relate to, or contain, information in respect of, First Quadrant and its management of the assets of certain accounts and investment strategies referred to herein. This information may be subject to updating, completion and amendment. Any performance data and other information in communications contained on this website illustrates the performance of the relevant accounts and strategies (as applicable), and/or provides information in relation to them, in respect of the period during which First Quadrant was appointed as investment manager. The members of the Systematica Group take no responsibility for any such data or information which has not been checked or verified independently by any of the members of the Systematica Group. There is no guarantee that past performance of the relevant accounts and strategies (to the extent managed by First Quadrant) will be replicated under the management of the Systematica Group.

DISCLOSURE

Citigroup

Events disclosed in connection with Rule 506(e)

1. Regulatory action initiated by Commodity Futures Trading Commission against Citigroup, Inc. (“Citigroup”) and Citigroup Global Markets Ltd. (“CGML”) for violation of Section 4a(b)(2) of the Commodity Exchange Act and Commission regulation 150.2 in that Citigroup, via its wholly owned subsidiaries, held aggregated net long positions in wheat contracts that exceeded the all months speculative position limits established by the commission as a result of trading on the Chicago Board of Trade (“CBOT”). In addition, CGML individually held net long positions in wheat contracts that exceeded the all months speculative position limits established by the commission as a result of trading on the CBOT. Action resulted in the issuance of consent order to cease and desist and civil monetary penalty in the amount of $525,000. Without admitting or denying the findings, respondents consented to cease and desist and a civil monetary penalty in the amount of $525,000. (Resolution Date: 09/21/2012).

2. Regulatory action initiated by Board of Governors of the Federal Reserve System (the “Federal Reserve”) against Citigroup and CitiFinancial Credit Company (“Citifinancial” and together with Citigroup, “Citi”) resulting in issuance of a consent order to cease and desist (the “Consent Order”). The Consent Order made no finding on any issues of fact or law nor any explicit allegation concerning Citi. The Consent Order described a consent order that the Office of the Comptroller of the Currency (the “OCC”) and Citibank, N.A. (the “Bank”), which is owned and controlled by Citigroup, entered into addressing areas of weakness identified by the OCC in residential mortgage loan servicing, loss mitigation, foreclosure activities, and related functions. The Consent Order also stated that the OCC’s findings, which the Bank neither admitted nor denied, raised concerns that Citi did not adequately assess the potential risks associated with such activities of the Bank. The Consent Order stated it is the common goal of the parties to maintain effective corporate governance and oversight over the consolidated organization relating to the weaknesses identified by the OCC consent order. In addition, the Consent Order stated that it is the further goal of the parties to effectively manage their legal, reputational, and compliance risks. The Consent Order required Citi and their institution-affiliated parties to cease and desist and take specified affirmative action, including that Citi or Citigroup’s board: (i) take steps to ensure the bank complies with the OCC consent order; (ii) submit written plans to strengthen risk management, internal audit, and compliance programs concerning certain mortgage loan servicing, loss mitigation, and foreclosure activities conducted through CitiMortgage, Inc. or Citifinancial; and (iii) periodically submit written progress reports detailing the form and manner of all actions taken to secure compliance with the OCC consent order. Citi agreed to consent to a settlement with the Federal Reserve. In the settlement, Citi agreed to consent to the entry of the Consent Order, without the Consent Order constituting an admission by Citi or any of theirs subsidiaries of any allegation made or implied by the Federal Reserve in connection with the matter (Resolution Date: 04/13/2011).

3. Civil judicial action initiated by the Securities and Exchange Commission (the “SEC”) against Citigroup for violations of Section 17(a)(2) of the U.S. Securities Act of 1933 (the “Securities Act”), Section 13(a) of the U.S. Securities Exchange Act of 1934 (the “Exchange Act”), and Exchange Act rules 12b-20 and 13a-11 in connection with disclosures made between July 2007 and October 2007 about the subprime exposure in Citibank’s investment banking unit. As alleged in the complaint, a violation of Section 17(a)(2) of the Securities Act may be established by a showing of negligence. The specific allegations are that Citigroup misled investors when it stated that it had reduced the investment bank’s subprime exposure from $24 billion at the end of 2006 to $13 billion or slightly less than that amount, while, in fact, the investment bank’s subprime exposure also included approximately $43 billion of “super senior” tranches of subprime collateralized debt obligations and related instruments called “liquidity puts.” On July 19, 2010, Citigroup submitted a consent to judgment which was presented by the SEC in the United States District Court for the District of Columbia (the “Court”) on July 29, 2010. In the consent, Citigroup consented to the entry of final judgment as to defendant Citigroup without admitting or denying the matters set forth therein (other than those relating to the jurisdiction of the court and the subject matter of the action). The final judgment resolved the allegations set forth in a complaint filed by the SEC, described above. The Court entered the final judgment where Citigroup was permanently enjoined from violating Section 17(a)(2) of the Securities Act, Section 13(a) of the Exchange Act, and Exchange Act rules 12b-20 and 13a-11. Citigroup agreed to pay disgorgement in the amount of $1 and a civil monetary penalty of $75 million. Citigroup paid the disgorgement and civil penalty on October 22, 2010. In a related matter, the SEC settled an administrative cease-and-desist proceeding relating to Exchange Act Section 13(a) and Exchange Act Rules 12b-20 and 13a-11 with a current employee of Citigroup and a former employee of Citigroup (Resolution Date: 10/19/2010).

4. Regulatory action initiated by the Federal Reserve against Citifinancial for failure to comply with SEC. 202.7(d)(1) of Federal Reserve Board Regulation B (“Regulation B”) and 15 U.S.C. 1691 et seq., which prohibit a creditor from requiring the signature of a co-applicant if the applicant qualifies based on his or her creditworthiness, engaging in unsafe and unsound practices under 12 U.S.C. 1818(i)(2)(b) in connection with its underwriting and lending practices with respect to certain loans subject to 15 U.S.C. 1639 and Federal Reserve Board Regulation Z (“Regulation Z”), and engaging in unsafe and unsound practices under 12 U.S.C. 1818(i)(2)(b) relating to its actions to allegedly mislead examiners in connection with examiner interviews of Citifinancial employees. Citigroup and Citifinancial consented to the imposition of an order to cease and desist and order of assessment of a civil money penalty. The order required Citifinancial and its institution-affiliated parties to cease and desist from practices and policies that violate SEC. 202.7(d)(1) of Regulation B and from unsafe and unsound practices in connection with Citifinancial’s underwriting and lending activities, SEC. 202.7(d)(1) of Regulation B, and comply with all applicable consumer protection laws, rules and regulations. Citifinancial was required to submit a restitution plan to the Federal Reserve concerning the alleged Regulation B and Regulation Z violations and pay a civil monetary penalty of $70 million subject to a partial credit of up to $20 million to the extent that restitution payments were made. The total funds available for restitution were expected to exceed $50 million. Finally, the order imposed certain remedial measures in the areas of compliance, audit, training, internal controls and interactions with regulatory authorities (Resolution Date: 5/27/2004).

5. Case No. SEU-2006-002. The State of Hawaii’s Commissioner of Securities, Department of Commerce and Consumer Affairs conducted an investigation to determine whether Citigroup Global Markets Inc. (“CGMI”) engaged in any violation of the Hawaii Uniform Securities Act, Hawaii Revised Statutes and other applicable authority with respect to a Hawaii investor’s claim that his telephone order to purchase penny stock was misplaced by a CGMI securities salesperson, which allegedly resulted in a settlement balance that was larger than the investor expected. In April 2013, without admitting or denying the allegations, CGMI entered into a consent agreement with the Hawaii Commissioner of Securities, in which CGMI agreed to make a restitution payment to the investor in the amount of $33,240 and $9,000 to the state for the cost of the investigation.

6. Matter No. 2012-0090 (Oct. 26, 2012). The Massachusetts Securities Division alleged that CGMI violated Mass. Gen. Laws Ch. 110, Section 204(a)(2)(f), 204(a)(2)(g), 204(a)(2)(j), and 950 CMR Section 12.204(1)(a) for allegedly failing to supervise certain research analysts, during the period between December 1, 2011 and May 2, 2012. Without admitting or denying the allegations, CGMI consented to a cease and desist order, censure, civil penalty in the amount of $2,000,000, and an undertaking to review written supervisory policies and procedures related to Citigroup Investment Research (“CIR”) electronic surveillance program and training provided to CIR equity research analysts, CIR supervisors, and CIR compliance personnel.

7. I08-345 (Mar. 31, 2011). The State of Nevada alleged that CGMI failed to ensure compliance with its supervisory requirements when one of its sales representatives improperly set up brokerage accounts for a customer between 1995 and 2008. Without admitting or denying the allegations, CGMI consented to an order to cease from future violations, and to pay both costs of investigation in the amount of $25,000 and a fee for inspection of records in the amount of $1,000.

8. 2010-0329-S (December 15, 2010). The State of New York Insurance Department (2010-0329-S) alleged that Citicorp Insurance Agency, Inc. (“CIAI”) and Citicorp Investment Services (“CIS”), both of which merged into CGMI, and SBHU Life Agency, Inc. (“SBHU”) violated Section 51.5(c) of the New York Regulation 60 by failing to present complete, accurate and/or timely disclosure statements to applicants in replacement transactions (from January 1, 2003 through December 31, 2007). CIAI, CIS and SBHU did not adequately process and resolve certain client complaints pertaining to the sale of life insurance policies or annuity contracts. Certain sales of life insurance policies or annuity contracts were inconsistent with CIAI, CIS and SBHU’s internal suitability standards. Action resulted in a stipulation agreement among the parties. CIAI, CIS and SBHU consented to the imposition of a civil penalty of $2 million and to take certain remedial actions described by the stipulation agreement.

9. 10-0477 CA (Oct. 26, 2010). The Indiana Securities Division alleged that CGMI violated Indiana Code Section 23-2-11 and 710 Ind. Admin. Code 1-17 by failing to adequately supervise a registered representative. It was alleged that the representative, for a period from September 2004 to May 2005, engaged in a scheme, along with a CGMI customer, to misappropriate funds from cemeteries in Indiana over which the customer had acquired control. While denying liability and without the entry of any findings of fact or conclusions of law, CGMI consented to an order of a fine in the amount of $400,000, restitution in the amount of $142,000, and costs of investigation in the amount of $175,000.

10. I07-044-JN (Oct. 22, 2010). The State of Nevada alleged a violation of NRS 205.960(1)(a) by CGMI. CGMI allegedly failed to properly supervise certain accounts handled by its representatives between 1999 and 2004 with respect to a brokerage account, which should have been opened as qualified escrow accounts or qualified trusts, and as such, failed to follow its policies and procedures with respect to the supervision and approval of such accounts. Without admitting or denying the findings, CGMI consented to an order to cease future violations and to pay $125,000 for costs of investigation.

11. AP-10-22 (Oct. 20, 2010). The Missouri Securities Division alleged that CGMI violated Missouri law (Section 409.4-412, (d)(9), RSMO. (Cum. Supp. 2009)) by failing to reasonably supervise a registered representative. The representative was alleged to have made improper recommendations, over a period of time from 2000 to 2007, relating to the retirement accounts and investments of a customer. Without admitting or denying the allegations, CGMI consented to an order of censure, restitution in the amount of $195,000, a fine in the amount of $75,000, and costs of investigation in the amount of $3,750.

12. IC10-CAF-12 (May 3, 2010). The State of Texas alleged that CGMI failed to deliver to the Director of the Inspections & Compliance Division of the Texas State Securities Board, notice of five client arbitrations/complaints as required per an undertaking with the Securities Commissioner and failed to enforce written policies and procedures designed to achieve compliance with the Texas Securities Act. In so doing, CGMI allegedly failed to enforce written procedures designed to achieve compliance with the Texas Securities Act. Without admitting or denying the findings, CGMI consented to an order of reprimand, and an administrative fine in the amount of $130,000.

13. Complaint – 08 CIV 10753 (RMB) (S.D.N.Y. Dec. 11, 2008); Sec Lit Rel. No. 20824. The SEC finalized a settlement with CGMI that provided nearly $7 billion to tens of thousands of customers who invested in auction rate securities before the market for those securities froze in February of 2008. The settlement resolved the SEC’s charges that CGMI allegedly misled investors regarding the liquidity risks associated with Auction Rate Securities (“ARS”) that it underwrote, marketed and sold. Previously, on August 7 and 8, 2008, the SEC’s Division of Enforcement announced a preliminary settlement with CGMI. According to the SEC’s complaint, filed in federal court in New York City, CGMI misrepresented to customers that ARS were safe, highly liquid investments that were comparable to money markets. According to the complaint, in late 2007 and early 2008, CGMI knew that the ARS market was deteriorating, causing CGMI to have to purchase additional inventory to prevent failed auctions. At the same time, however, CGMI was alleged to have known that its ability to support auctions by purchasing more ARS had been reduced, as the credit crisis stressed CGMI’s balance sheet. The complaint alleged that CGMI failed to make its customers aware of these risks. In mid-February 2008, according to the complaint, CGMI decided to stop supporting the ARS market, leaving tens of thousands of CGMI customers holding tens of billions of dollars in illiquid ARS. The settlement, which was subject to court approval, restored approximately $7 billion in liquidity to CGMI customers who invested in ARS.